Our long standing mission is to increase the retirement readiness of employers, and employees of small businesses through the design and detailed compliance administration of high quality retirement plans. From our very beginnings, we have been dedicated to providing the highest quality of service and plan administration possible. We take pride in our continued focus on innovation in all areas of retirement plan administration. Our Next Level service platform is focused on providing innovative service and educational products not found at other typical TPA firms.

401(k) PLAN SERVICES

- Customized Plan Design

- Creation of Plan Documents

- Annual Non-Discrimination Testing

- Annual Form 5500 Preparation

- Contribution Calculation & Analysis

- Comprehensive Audit Assistance

- Online Fiduciary Document Vault

- Creation of Participant Disclosures

- Compliance Education for Plan Sponsors

- Customized Participant Enrollment Education

- Loan and Distribution Review

- Dedicated IRS and Legislative Update Compliance

- 3(16) Fiduciary Services

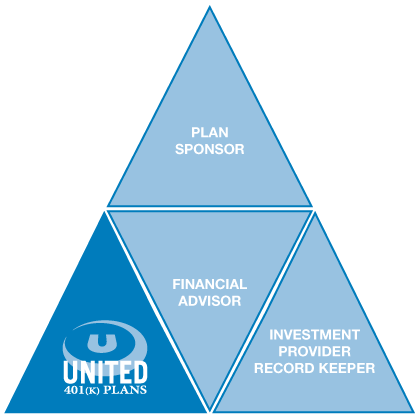

OUR ROLE IN THE RETIREMENT PLAN

At the top, there’s your company or the Plan Sponsor. To assist you, the Record Keeper holds investment accounts and the Financial Advisor consults you about investment options. United 401(k) Plans acts as the Third Party Administrator and ensures plan compliance by:

- Designing a plan that best fits your needs

- Creating plan documents and keeping them up-to-date

- Creating plan amendments as necessary

- Accurately preparing the annual form 5500

- Adjusting plan provisions as your company evolves

- Promptly reviewing loan and distributions

- Preparing required participant notices

- Promptly responding to employer questions & concerns

- Assisting participants

ADVISOR PLAN SUPPORT SERVICES

Introducing United 401(k) Plans Advisor Plan Support (APS). APS was developed to assist Advisors in effeciently operating and monitoring their 401(k) plans under management. Through APS, Plan Sponsor’s fiduciary risks are minimized by the diligent performance of key responsibilities and record retention.

- Regular Fund Monitoring Reports

- Annual Plan Review Meeting with Fiduciary Record Management

- Plan Design Monitoring and Consultation

- Online Fiduciary File Document Vault

- Plan Sponsor Compliance Education